With almost everything going up in cost, it’s more important than ever for businesses to find ways to reduce spending.

Many organizations spend too much money on business technology. This over-expenditure can be in the form of unused resources, such as software licenses and various services.

This post will look at technology areas where your business can save money.

1. Stop paying for SaaS licenses you’re not using

Subscriptions to SaaS (Software as a Service) applications have increased across companies of all sizes.

Certain cross-functional apps such as Google Workspace, Microsoft 365, Zoom, and Slack have 100% user adoption rates.

However many SaaS apps are redundant or underutilized, resulting in “SaaS sprawl.” In a study, Productiv found that less than half of licensed employees regularly use the apps available to them.

Keep a list of all known SaaS subscriptions in a master spreadsheet. Then, periodically review the list and decide if there should be a reduction in license count for specific apps — or if some subscriptions should be terminated.

There are also Shadow IT apps, which are apps that employees subscribe to directly and add to their expense reports. Work with finance to add shadow apps to your master SaaS list.

You may find many apps that can have the user license count reduced. Other apps can be eliminated.

While Zoom is the best-known brand for meetings, organizations that subscribe to Google Workspace and solopreneurs who use Google Workspace Individual can host online meetings using Google Meet for no extra charge.

2. Use lower-TOC desktop hardware and software

Regarding employees’ desktop and laptop computers, it’s essential to look at the total cost of ownership (TOC) — not just the purchase price of a desktop or laptop computer.

Microsoft’s Windows still dominates the global desktop operating system market with an approximate 75% share.

While Windows is better than ever, IT staff can spend much time configuring and supporting Windows machines.

Apple’s mac OS is in second place, with a share of about 15%. Corporate adoption of Macs is on the rise, partly because Mac M1s and M2s require less IT setup and support time than PCs.

A study commissioned by Apple showed that Macs improve employee performance and engagement, which resulted in cost savings. Over three years, the TOC of a Mac was $843 less than a PC.

Apple MacBook Air currently tops the list of Amazon best sellers.

Chrome OS has an even smaller global market share than macOS (2.5%), but Chromebooks and Chromeboxes are cheaper to set up and maintain than Macs. Chromebooks have no locally installed software, and operating system updates happen automatically in the background.

By installing ChromeOS Flex, enterprises can make an old fleet of PCs and Macs function like Chromebooks. Bringing an old laptop or desktop back to life means not purchasing new hardware.

Chrome OS and ChromeOS Flex are cost-saving options for employees who don’t need to run any locally installed software.

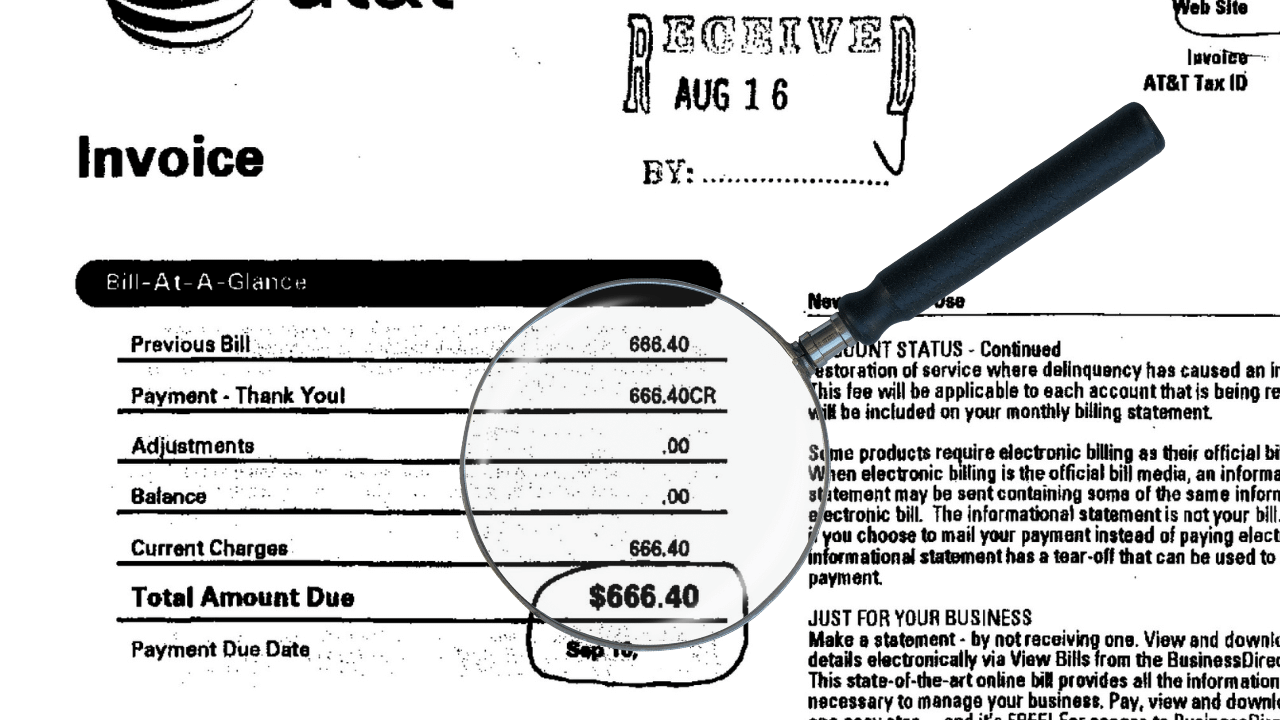

3. Analyze your internet service provider (ISP) invoices

When was the last time you scrutinized your internet bills? Many companies are overpaying for internet service.

Find out if your internet service provider has a better deal for the current level of service — or even a higher level of service.

As a cost-saving measure, consider whether a cheaper ISP serves your location.

4. Look at your company’s phone bills

Do you have a legacy phone system and are paying for unused telephone lines? If so, consider moving to a cloud-hosted telephone system such as Google Voice.

You may have other unused phone lines that were once connected to security systems and fax machines.

5. Move your servers to the cloud

Do you still have racks of servers in a computer room in your office?

Companies that need to run servers can use services like Microsoft Azure, Amazon AWS, and Google Cloud.

Hosted virtual servers mean spending less money on hardware and maintenance costs.

6. Take advantage of solar energy tax credits and deductions

If you own your building and have high electricity bills, a solar energy investment now has a faster payback than ever.

In addition to the standard 30% federal tax credit, some businesses may be eligible for up to 30% of additional credits, depending on circumstances. These credits are

- Domestic Content Bonus: 10%

- Energy Community Bonus: 10%

- Low-Income Community Bonus: 10%

Bonus depreciation through the Modified Accelerated Cost Recovery System (MACRS) is being phased out but still represents a tax saving.

Check with your accountant on the details of solar credits and deductions.